Here is the full breakdown of the Italian Luxury Tax and how you can add it to your aircrafts pricing profiles to ensure accurate pricing in the Marketplace.

Background: Each passenger onboard a commercially-operated private jet flight arriving at or departing from an Italian airport is subject to Italian Luxury Tax (Italian Aero Taxi Tax). The tax is due by each passenger and the rate is based on the distance between the point of origin to the destination for flights to, from and within Italy.

-

10 EUR per PAX if distance is less than 100 km (NOT supported in Avinode / Schedaero, currently)

-

100 EUR per PAX if distance is more than 100 km but less than 1500 km

-

200 EUR per PAX if distance is greater than 1500 km

(The distance calculations are referenced to the great circle track + 95 km)

Good news, the Italian Luxury Tax (ILT) can now be implemented in your pricing profile(s).

The two higher distance bands are supported and available as optional line items to implement in your pricing profile:

By including the two line items into your pricing profile, one of the two different rate types will automatically be applied (per passenger) to your Avinode prices for trips to, from & within Italian territory. The system will recognize a trip's distance and add the applicable rate by default: either the "Italian Luxury Tax (Short distance)" if the trip is 100 - 1500 km, or the "Italian Luxury Tax (Long distance)", if the trip's distance is greater than 1500 km.

For domestic Italian trips, ILT is charged once per PAX and leg.

How to implement the ILT line items:

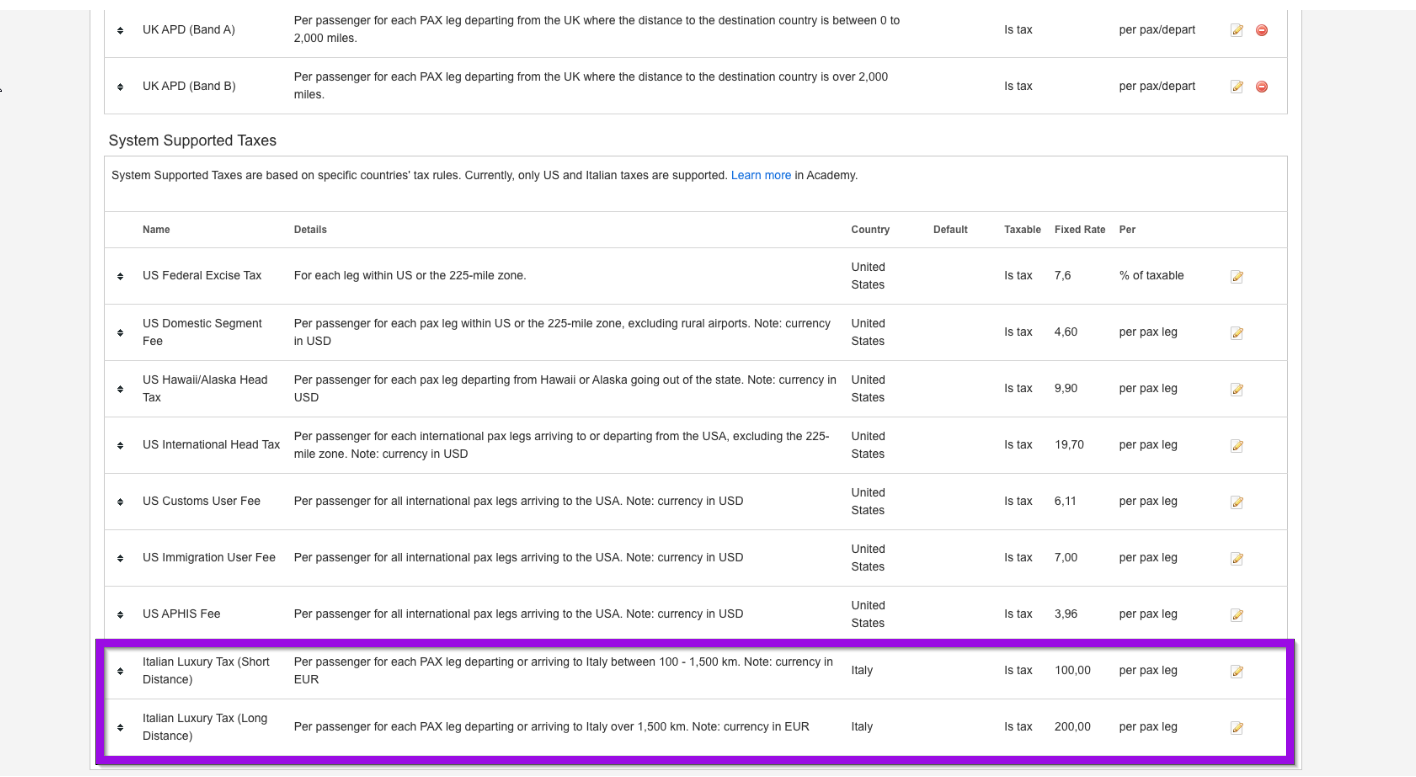

The ILT options are found in your company pricing settings under the “System Supported Taxes” section.

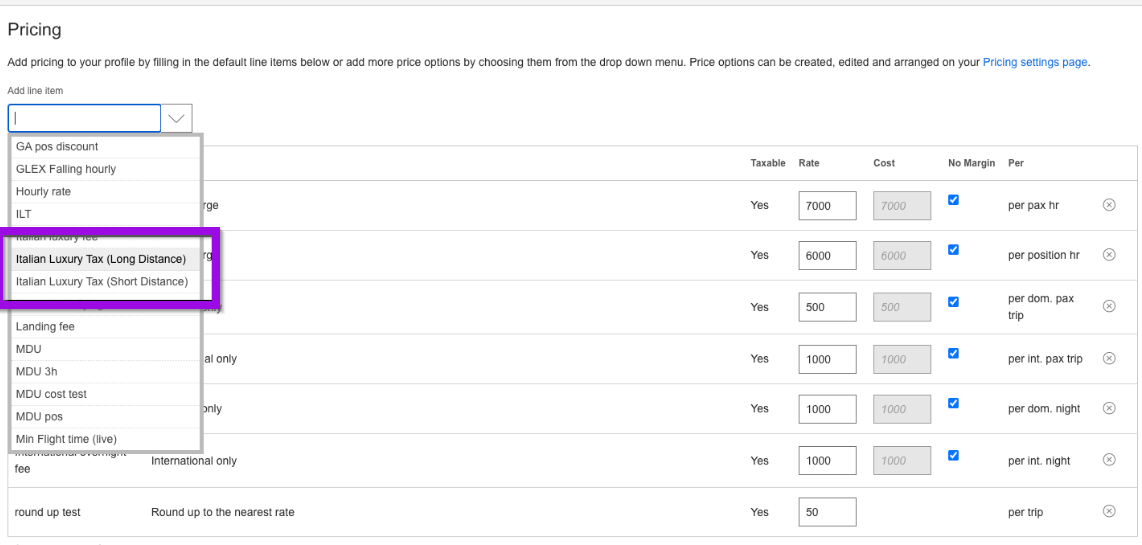

The line item(s) have to be added into your desired pricing profiles.

To implement the ILT into your pricing profile, you will need to add the 2 line items called "Italian Luxury Tax (Short distance)" and "Italian Luxury Tax (Long distance)", by using the corresponding drop down menu. The ILT line items are available to all operators in Avinode and Schedaero.

By default, the rates (in EUR) are auto-populated in accordance with the actual ILT rates which shall apply for the two higher distance bands.

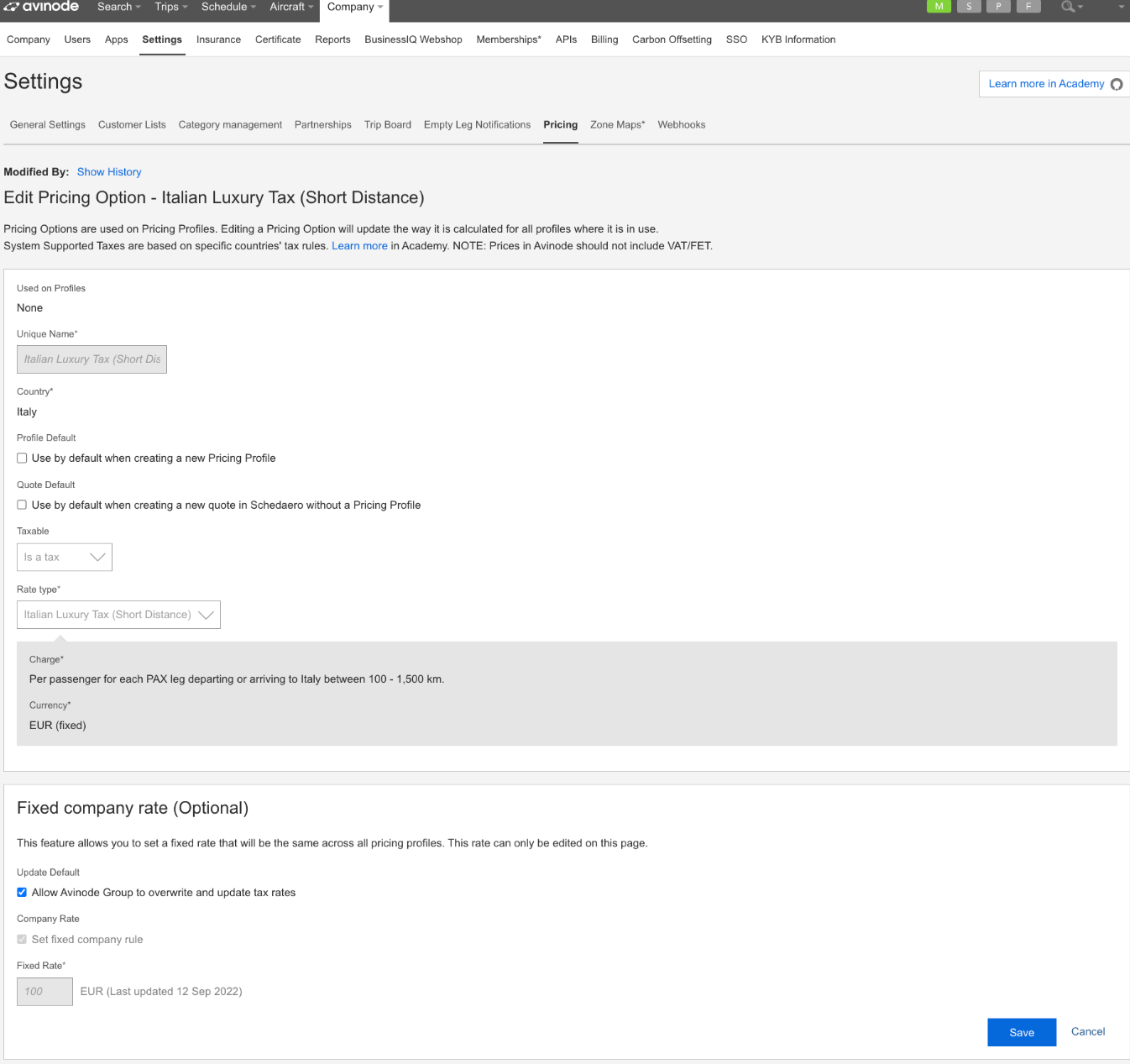

Please NOTE that you may also decide to override these rates with different ones if you wish. To do so, you'll first need to uncheck the "Allow Avinode Group to overwrite & update tax rates" option that is available under Company > Settings > Pricing, Edit "Italian Luxury Tax (...)" pricing option.

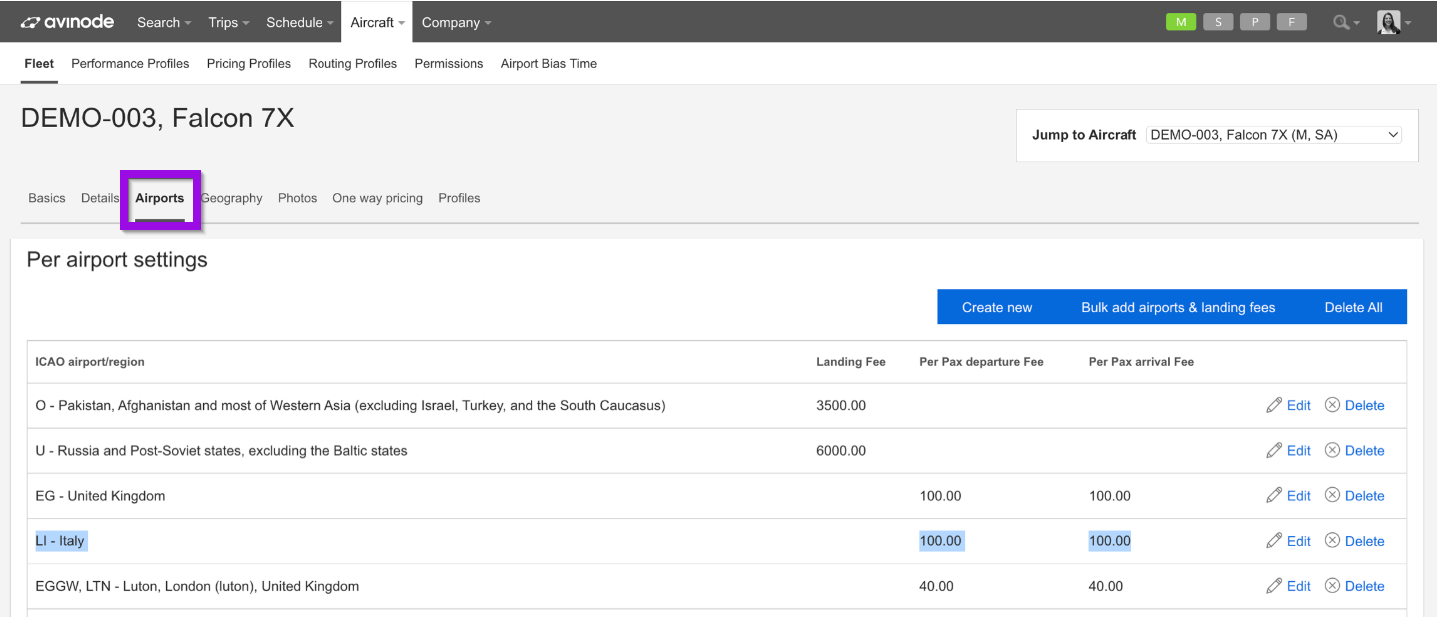

Remove any of your previous workarounds (e.g. ILT in your Airport fees)

PRO TIP! Finally, don’t forget to remove any existing work-arounds that you might have added, so it doesn't get calculated twice.

For example, in case you have set up a per pax departure/arrival fee under the Airports tab for Italian airports in the Aircraft section.

Please do not hesitate to reach out to support@avinode.com if you have any further questions or wish to provide product feedback.

Grazie!